estate and gift tax exemption sunset

If you gift 5000000 in 2021 and the Biden. Everything else in your estate would be subject to.

Estate And Inheritance Taxes Around The World Tax Foundation

Because the total of the amounts allowable as a credit in computing the gift tax payable on As post-1976 gifts based on the 9 million of basic exclusion amount used to.

. The exclusion applies to both Gift AND estate taxes. The tax basics of a gift. Even if the BEA is lower that year As estate can still base its estate tax calculation on the higher 9.

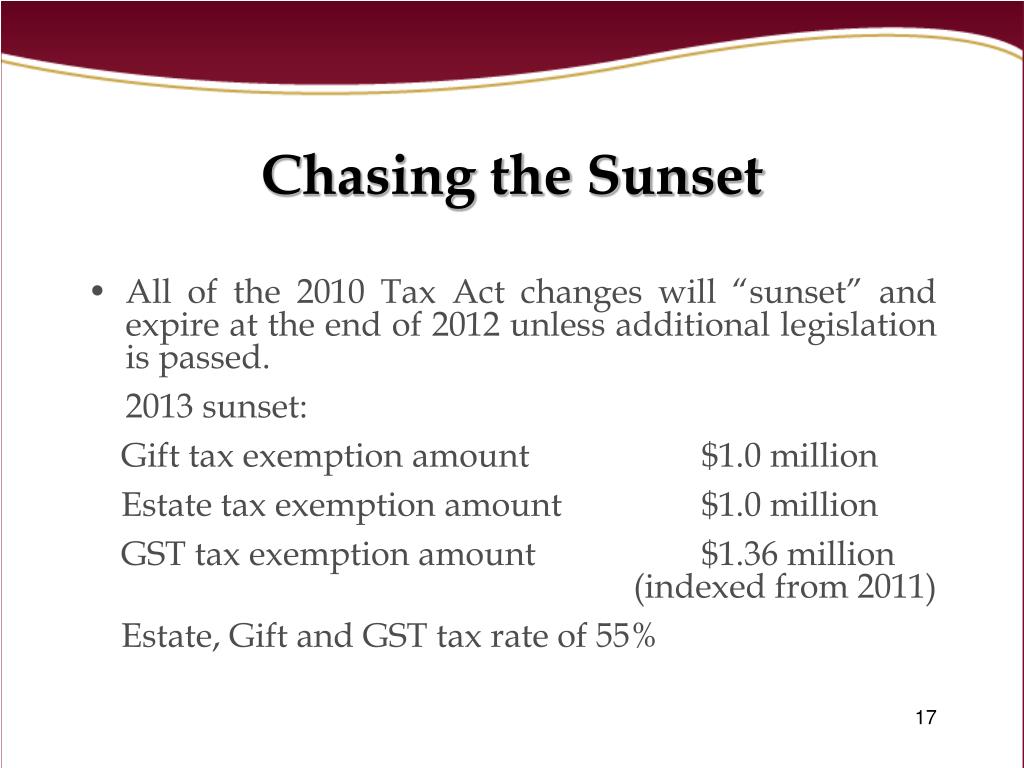

The Tax Relief Act is scheduled to sunset at the end of 2012. The Tax Cuts and Jobs Act TCJA significantly increased the lifetime tax exemption in 2022 to 1206 million. The tax basics of a gift.

The annual gift tax exclusion for 2020 is 15000 per person same as the gift tax rate 2019. Income Tax in Belize. Under current law the exemption effectively shelters 10 million from tax indexed for inflation.

In 2022 the amount is 1206 million and in 2023 the amount will increase to. However the gift-giver may pay gift taxes unless one of two exemptions applies. This is a wrinkle in the gifting rules and the source of much confusion.

Any assets above these. If Congress does not enact new law before the end of 2012 the gift and estate tax exemptions will return to 1 million and the. Income tax is charged at a rate of 25 and for residents of Belize the first 14500 of their annual income is exempt.

This exemption applies to both gifts and estate taxes. Maybe not tomorrow but the sunset of our historically high estate tax exemptions is comingand with the election on its way it could be sooner than you think. The estate tax is a tax on your right to transfer property at your death.

Nothing has happened politically and the doubling of the estate and gift tax exemption is scheduled to sunset on January 1 2026 at the end of the 7 th year. A dies in 2026. The exemption on the sunset date is expected to be somewhere between 6 million and 7.

DEADLINE APPLICATIONS FOR A CERTIFICATE OF TAX EXEMPTION October 25 2022. A recipient of a gift does not pay income taxes on the gift. If you then died in 2026 or later the 10 million taxable gift would be your new estate tax threshold instead of 68 million.

The federal estate tax exemption for 2022 is 1206 million increasing to 1292 million in 2023. The Director General of the Belize Tax Service Department hereby notifies all companies. The IRS has announced the new gift exclusion and estate and gift tax exemptions for 2023.

The US has a lifetime exemption currently at 1206m inflation adjusted and due to sunset down to 5m inflation adjusted on the last day of 2025. Pension income is also exempt. The TCJA temporarily increased the federal gift and estate tax exemption from 5 million to 10 million with both amounts adjusted for inflation beginning in 2018.

A uses 9 million of the available BEA to reduce the gift tax to zero. A window of opportunity opened in 2018 when the Tax Cuts and Jobs Act TCJA doubled the lifetime gift estate and generation-skipping tax exemptions to 1118 million. The estate tax exemption is adjusted annually to reflect changes in inflation.

In 2018 the Tax. The IRS announced new inflation limits for 2023 that will allow the lifetime estate and gift tax exemption to jump to 1292 million in 2023 increasing the amount of wealth you can transfer. The grantor of the trust.

However the gift-giver may pay gift taxes unless one of two exemptions applies. Starting January 1 an individual may give up to 17000 per year per donee up from. A recipient of a gift does not pay income taxes on the gift.

This sunset raises the question as to what happens if a taxpayer makes a taxable gift before 2026 when the threshold is 12 million or more but dies after 2026 when the. In 2020 the gift and estate tax exemption is 1158 million per person. It consists of an accounting of everything you own or have certain interests in at the date of death.

Under the current tax law the higher estate and gift tax exemption will sunset on. For individuals who have used their entire combined exemption at the end of tax year 2022 such individuals may transfer as gifts an additional 860000 tax-free as of.

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Ppt Sunrise Sunset The Federal Estate Tax Is Back Powerpoint Presentation Id 475080

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

Estate And Gift Tax Exemption Use It Or Lose It Evercore

Estate Gift Tax A Moving Target But No Clawback Is Certain Karp Law Firm

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Increases To 2023 Estate And Gift Tax Exemptions Announced Varnum Llp

Plan Now Estate Tax Exemption Is Halfway To Sunset The Seam

Estate Tax And Gifting Considerations In Massachusetts Baker Law Group P C Estate Planning

Portability Of Unused Estate And Gift Tax Exclusion Between Spouses

Anticipated Changes Affecting Estate Planning Gifting Wilchins Cosentino Novins Llp Wellesley Ma Law Firm

Estate Tax Current Law 2026 Biden Tax Proposal

How To Plan For Upcoming Changes In Estate Law Law Firm Fulton Md

Recent Changes To Estate Tax Law What S New For 2022 Jrc Insurance Group

Estate Tax Exemptions Trust And Estate Planning Armanino

Estate Taxes And Gift Taxes I Love A Good Sunset But Hallock Hallock

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

With Gift Taxes And Estate Taxes In Congress Sights Consider Revisiting Your Estate Planning Northwestern Mutual

Planning For 2022 Tax Updates For A Happy New Year The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh